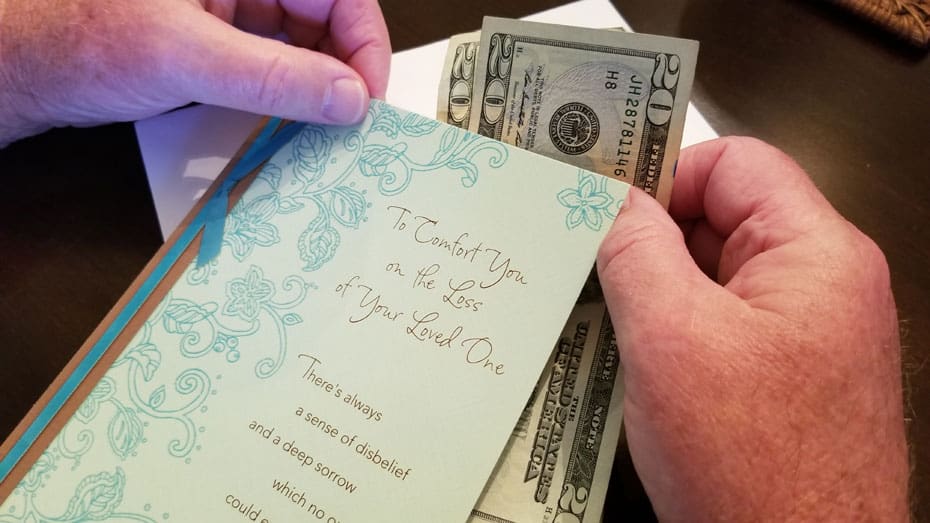

When applying for Medicaid, the government will presume that any transfers you made for less than fair market value in the last five years was done with the specific intent to qualify for Medicaid. Even if that was not your intention, Medicaid will treat the transfer as a gift. Under Medicaid rules, amounts gifted are treated as if they were still in your possession on the day you otherwise qualified for Medicaid and you will be penalized as if that cash was still in your bank account.

For example, Jane gave $15,000 to her grandson to help him with college. Three years later, she applies for Medicaid when moved into a skilled nursing facility. Even though that money is long gone, Nevada Medicaid will treat it as if that money was still in her bank account and could be used for her care. Even though she would otherwise qualify for Medicaid, she would be disqualified for a period of three months. This means that for a period of three months, Jane would not have any assistance from Medicaid even though she actually has less than $2,000 in the bank.

Larger gifts may cause an even longer disqualification period. In 2012, Nevada Medicaid penalizes a person at the rate of $7,200 per month for gifts that were given in the last five years. Hence, a gift of a $720,000 home less than five years ago could result in a disqualification penalty of 100 months – which is over eight years! Even though the period of time Medicaid can look back is limited to five years, the penalty once imposed is unlimited.

This may seem like an unrealistic situation, but sadly I have seen this occur in my own practice. Mom or dad lived in the Bay Area, or southern California, or Lake Tahoe, or even Genoa. To avoid probate, or streamline their care, they transferred title to their modest 3 bedroom house to their child. The house at that time was worth over half a million dollars. As mom and dad declined, their retirement accounts are exhausted and now four years later they are moved into skilled nursing. The nursing home promptly files for Medicaid because its bill needs to be paid. But, the five-year look back period has not expired yet. The penalty is imposed and now the family has to figure out a way to either undo the transaction or pay for the care for the next five plus years.

There are strategies to avoid these penalties, and to pass the house safely to a well spouse, dependent child, live-in caretaker child, or disabled dependent. These strategies need to be properly planned and implemented before mom or dad (or spouse) need to be moved into a skilled nursing facility and apply for Medicaid.

For starters, begin making your record now. It is so much easier to create records now, than to recreate the situation several years from now. The first step is to start writing a note on the memo line of your checks, especially any check written to an individual, noting what the check if for. Second, since we are in a gambling state, get a players card and track what you spend on gambling. If you cannot track it, then Medicaid will assume you gifted it to someone. Finally, if you are the recipient of a large gift – like the family home – be prepared to give it back. Often, Medicaid will waive the disqualification period if the gift can be undone.

There is no better time than now to begin planning for your, your parent’s, or your sick spouse’s care. Medicaid is not the only available resource. Good long term care planning will consider strategic uses of all available resources, including retirement assets, insurance, and government benefits. This planning must be carefully implemented so you are not disqualified from available resources.